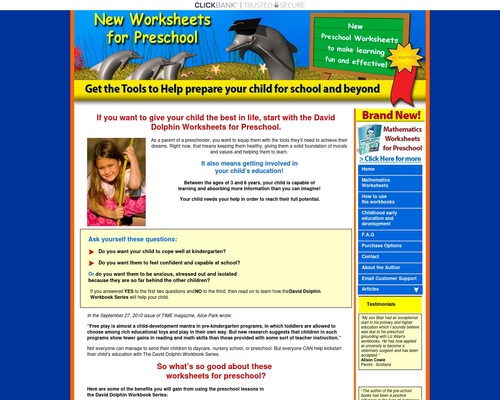

Rep the tools to attend put together your miniature one for varsity and past.

printable preschool worksheets

3 to 4 365 days Frail Worksheets

Worksheets for younger folk

3 to 4 years worn.

4 to 5 365 days Frail Worksheets

Worksheets for younger folk

4 to 5 years worn.

5 to 6 365 days Frail Worksheets

Worksheets for younger folk

5 to 6 years worn.

Mathematics Worksheets for younger folk 3 to 6 years worn.

About the preschool printable worksheets

Hi, I’m Liz Allan, creator of The David Dolphin Worksheets for Preschool.

I developed these preschool printable worksheets over the three decades I in point of fact were instructing preschool younger folk, the use of tried and tested programs which will be updated on a typical basis, to provide younger folk the abilities they need for junior school. I in point of fact own individually viewed the implications that my worksheets attend younger folk fabricate, and I do know that your miniature one will get hold of enjoyment from them too.

Queer

These newly released David Dolphin Workbooks are outlandish and own by no arrive been released to the public sooner than. You may perchance well probably additionally honest no longer get hold of preschool studying cloth like these anyplace else!

Age Particular

Every Workbook has been developed for a particular age-community, with workout routines which will be manageable, but no longer easy adequate to stimulate your miniature one.

Labeled

Every Workbook comprises many worksheets, divided into categories, or studying areas. The Workbooks quilt shapes, coloration, counting, sounds, writing, addition and subtraction and more.

Tested

Every preschool printable worksheet has been tested and perfected in my preschool – and the younger folk absolutely like them.

Selection

The actions most modern the the same studying ideas in assorted ways

to advertise thought and presents a enhance to memory. The preschool worksheets are on hand in USA english and UK english.

No Possibility to You

Whereas you are no longer cheerful with the David Dolphin Workbooks within 60 days, you may perchance well probably be refunded no questions requested and you get hold of to withhold the total books plus the total bonuses.

David Dolphin Printable Preschool Worksheets

3 to 4 365 days Frail Worksheets

117 Worksheets

Introducing the ideas of literacy and numeracy, this workbook introduces your miniature one to the alphabet, numbers, shapes and colours with stress-free-filled worksheets that invent the normal talents they’ll manufacture on for varsity.

4 to 5 365 days Frail Worksheets

115 Worksheets

These 4 to 5 365 days Frail classes introduces writing, builds on the normal data of counting, numbers, the alphabet, writing and drawing, offering your miniature one with the basis they need at some level of their training.

5 to 6 365 days Frail Worksheets

145 Worksheets

Easy addition, subtraction, reading and writing talents are honed in this workbook. Be aware is assorted so that your miniature one no longer handiest learns, but grasps the ideas uninteresting the studying.

3 to 6 365 days Frail Mathematic Worksheets

96 Worksheets

The David Dolphin Math Workbook comprises systematic, age-particular arithmetic worksheets to provide your miniature one a sturdy basis to manufacture on within the lengthy bustle.

As a guardian of a preschooler, you desire to equip them with the tools they’ll wish to fabricate their desires.

Factual now, that arrive retaining them healthy, giving them a sturdy basis of morals and values and serving to them to study.

It additionally arrive getting desirous about your miniature one’s education!

Between the ages of three and 6 years, your miniature one is in a position to

studying and bright more data than you may perchance well probably perchance additionally imagine!

Your miniature one needs your attend in remark in self assurance to attain their plump probably.